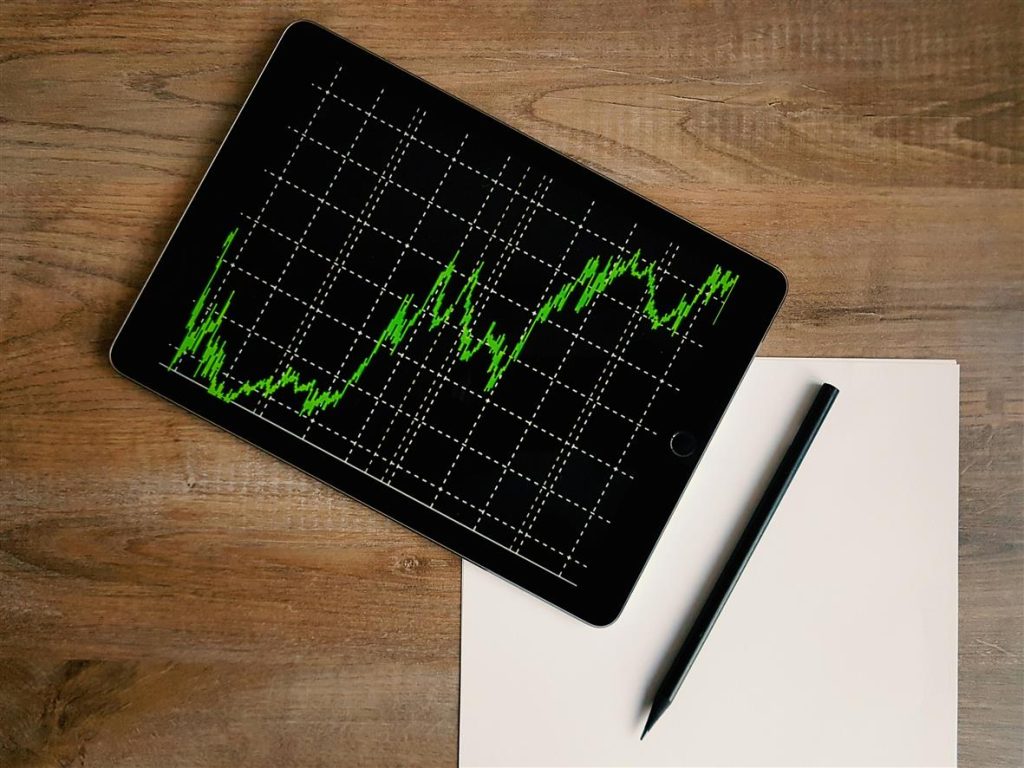

Compared to even a few years ago, the investing world has become more accessible. With lower (or no) trading fees, mobile platforms, and fractional shares, nearly anyone can start with as little as $10. But the ease of access doesn’t mean it’s simple — the market is more volatile, more crowded with opinions, and shaped by global shifts in interest rates, supply chains, and digital finance.

Some key trends shaping 2025:

- Interest rate fluctuations: Central banks are playing a balancing act between inflation and economic growth.

- Tech sector cooling: After years of rapid growth, tech stocks have leveled off, forcing investors to diversify.

- Alternative assets: From cryptocurrencies to real estate funds, people are looking beyond traditional stocks and bonds.

This isn’t a bubble or a crash — it’s a transition. And transitions, while noisy, offer opportunities.

Step 1: Know Why You’re Investing

This sounds obvious, but many skip it. Are you saving for retirement? A home? Passive income? A five-year travel sabbatical?

Your goal determines your risk tolerance. For example:

- Short-term goals (1–3 years): Stick to low-risk investments — high-yield savings, certificates of deposit (CDs), or money market funds.

- Medium-term (3–10 years): Balanced portfolios with a mix of stocks and bonds.

- Long-term (10+ years): Lean into higher-risk assets like stocks or real estate funds, as time is on your side.

The mistake beginners often make is diving in without this clarity. Investing is personal — what works for your friend might not suit your goals.

Step 2: Start with the Basics — Really

Despite all the TikTok “stock tips” and day-trading hype, your best starting point is boring — and that’s a good thing.

Here’s what that looks like:

- Index Funds or ETFs: These are baskets of stocks that track an index like the S&P 500. They offer instant diversification, lower risk, and usually minimal fees.

- Dollar-Cost Averaging (DCA): Instead of trying to time the market, invest a set amount on a regular schedule (e.g., $100 every two weeks). Over time, you buy at highs and lows, which helps smooth out risk.

- Avoid Stock Picking Early On: It’s tempting to think you’ve spotted the “next big thing.” In truth, even professionals often get it wrong. Stick to diversified investments until you have more experience.

Step 3: Understand Risk (And Yourself)

Risk isn’t just market crashes — it’s also about your emotional reactions. If a 10% drop in your portfolio sends you into a panic spiral, that’s a sign you may be invested too aggressively.

Ask yourself:

- Can I stomach temporary losses?

- Am I checking my portfolio obsessively?

- Do I compare myself to others’ gains?

A healthy investment approach balances potential growth with peace of mind. You don’t need to chase returns. You need to build something that lasts.

Step 4: Know the Tools

In 2025, there are more platforms than ever. Here’s how to choose:

- Brokerages like Fidelity, Vanguard, or Schwab: Ideal for long-term investing and IRAs.

- Apps like Robinhood, Public, or SoFi: Great for beginners but often encourage short-term thinking — be cautious.

- Robo-advisors like Betterment or Wealthfront: They build a diversified portfolio for you based on your goals and risk tolerance, for a small fee.

If you’re unsure, start with a robo-advisor. It removes decision fatigue and gets your money working while you learn.

Step 5: Avoid These Common Pitfalls

- Trying to time the market

You won’t succeed consistently. Not even the pros do. - Following hype

Social media is filled with bad financial advice. Vet sources, and remember: real investing isn’t flashy. - Neglecting fees and taxes

High fees can eat into your returns. Understand how your investments are taxed — especially if you’re outside a retirement account. - Not having an emergency fund

Never invest money you might need soon. Always have 3–6 months of living expenses saved separately. - Overreacting

Markets fluctuate. Your portfolio will drop sometimes. Stay calm and think long term.

Step 6: Keep Learning — At Your Pace

You don’t have to learn everything at once. But do commit to learning.

Some good beginner resources:

- Books: “The Simple Path to Wealth” by JL Collins, “I Will Teach You to Be Rich” by Ramit Sethi

- Podcasts: Animal Spirits, The Investors Podcast, BiggerPockets Money

- Blogs: NerdWallet, Morningstar, Mr. Money Mustache

Even 15 minutes a week will compound — just like your money.